ALTERNATIVE BANKING & CURRENCY SOLUTIONS

Institutional strength, Personal attention. Built for international business

$5bn

traded monthly through our liquidity providers

140

Tradable currencies under 1 account

30,000

Transactions a month through our liquidity providers

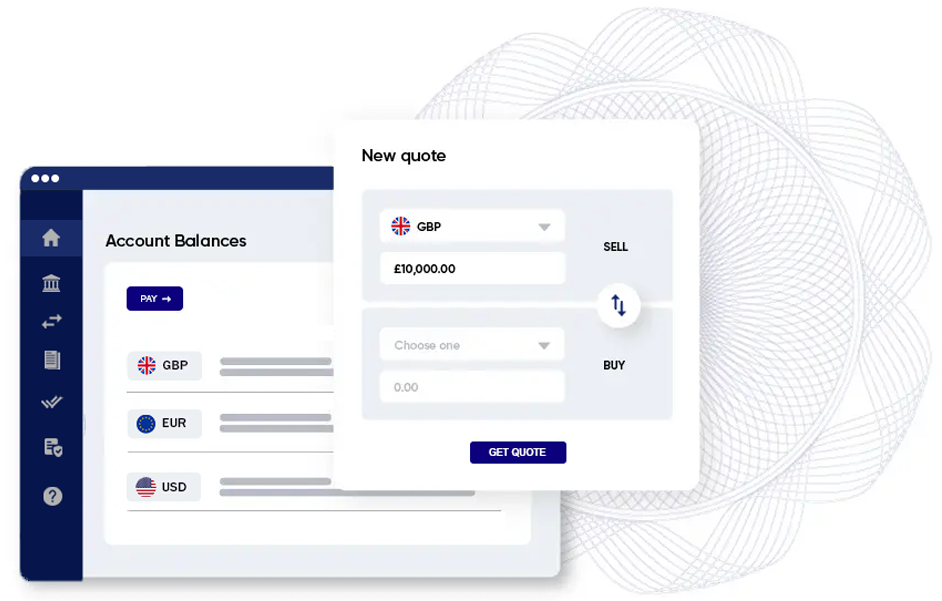

ALTERNATIVE BANKING

Multi-currency accounts

With a swift and straightforward onboarding process, your multi-currency account allows you to hold and receive funds while facilitating payments in over 140 currencies.

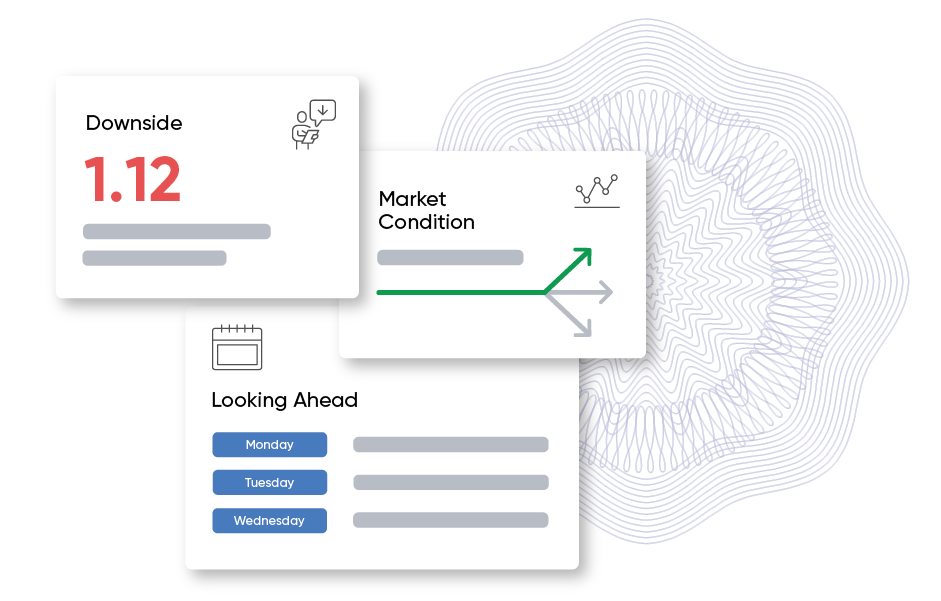

BESPOKE CURRENCY MANAGEMENT

Tailored Solutions

Your dedicated risk manager will provide expert guidance on foreign exchange strategies and hedging solutions, designed to align with your specific objectives.

CUSTOMISED HEDGING STRATEGIES

Hedging currency exposure

Access customised hedging strategies and a broad product portfolio to help you achieve the goals within your risk management framework or treasury policy.

FX MARKET ANALYSIS

Weekly FX analysis at your finger tips

Receive concise technical and fundamental analysis along with a schedule of key data releases for the week ahead. Delivered to your inbox every Monday.

I’ve been working with Crownline for about a year now, and honestly, they’ve made my life so much easier. Had my Euro & Dollar account details set up in 24 hours. Thanks Sonny

We import tiles from Italy and Turkey, and payments used to be a bit of a nightmare. Crownline International /Josh Spearpoint sorted us out with great rates. Couldn’t be happier with the service.

We’ve got projects running in Europe, and payments used to cause so many delays. Crownline allowed us to receive payments in multi-currency accounts and made everything simple. Couldn’t recommend them more. Cheers!

I deal with galleries all over, and payments have always been stressful. With Crownline, it’s simple. They’re so on it – it feels like I’ve got a whole team working just for me. Can’t recommend them enough.

Initially I was being charged 3% via my bank! Crownline made the process so much easier for me. They’re always on direct dial to help, and I know I’m getting a decent rate every time.

I was initially sceptical, having dealt with brokers who overpromise and underdeliver. However, this team is different -they genuinely care and ensure everything runs smoothly, special thanks to Sonny. The rates are excellent too.

We film in Europe and the US, and handling payments for crew and equipment can be a pain. Crownline have been brilliant – they’re quick, reliable, and always there to sort any issues. Lifesavers, honestly.

Honestly, I don’t have the bandwidth to worry about payment issues. Crownline International makes everything seamless – friendly, efficient, and always reliable. Ideal for high value transactions.

Crownline have been a huge help. Before, I’d be chasing payments or paying fees I didn’t even understand. Now, I know exactly what I’m paying and when it’ll arrive. Such a weight off my shoulders.

We’ve worked with Crownline for about six months, and I’ve already noticed the difference. They’re not just another broker – they actually know our business and make suggestions that save us money. Proper service. Thanks Ben!

I don’t usually leave testimonials, but I had to for Crownline International. They’ve made exporting to the Middle East so much easier for me. Payments are fast, and they’re always quick to reply if I need anything.

Great team, really knowledgeable. I’ve had to deal with some awkward payment setups for overseas projects at other companies, and they’ve always found a solution. Wouldn’t hesitate to recommend them to anyone.